- Advertisement -

The Ghana National Chamber of Commerce and Industry (GNCCI) is calling on the government to simplify and merge all existing taxes and levies into a single transparent system in the upcoming 2026 budget.

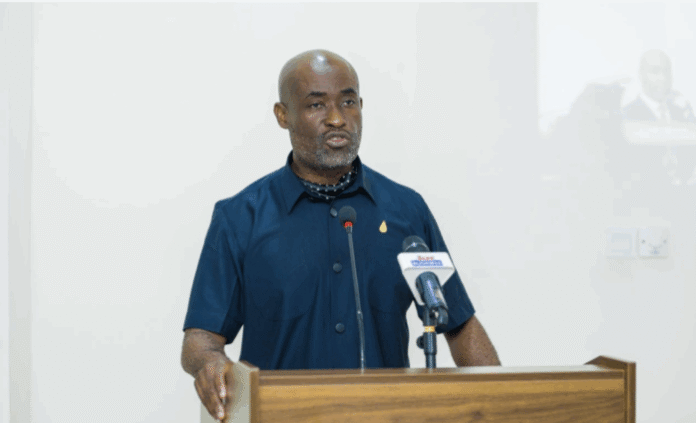

Speaking at the 49th Annual General Meeting of the Chamber, President Stephane Miezan said the current complex tax regime discourages compliance and stifles business growth.

Also Read: PIAC facing bleak future after removal from ABFA funding

He recommended that the government introduce a turnover and employment-based tax to replace multiple levies, remove VAT on insurance services to enhance accessibility, and grant a three-year tax holiday for start-ups to promote entrepreneurship and job creation.

The Chamber further urged policymakers to engage the private sector in the formulation of tax policies to ensure fairness and efficiency in revenue mobilization.