Ghana’s allocation of Special Drawing Rights (SDRs) with the International Monetary Fund (IMF) stood at US$1.45 billion as of end-September 2025, according to the Q3 2025 Quarterly Statistical Bulletin released by the Bank of Ghana.

The latest figure represents an increase from the US$1.38 billion SDR allocation recorded in January 2025, reflecting a modest improvement in the country’s reserve position over the period under review.

The SDR allocation forms part of the Bank of Ghana’s gross international reserves, which stood at US$11.6 billion at the end of September 2025.

Also read: Gov’t rejects GHS 11.42bn in T-bill bids as auction oversubscribed by 246%

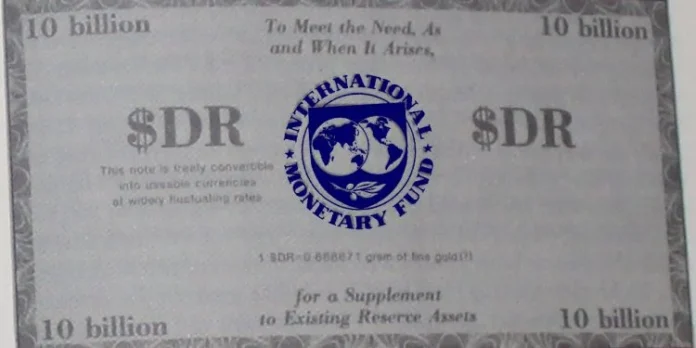

Special Drawing Rights are international reserve assets created by the IMF to supplement the official reserves of its member countries. While SDRs are not a currency in themselves, they represent a potential claim on the freely usable currencies of IMF members and can be exchanged to provide liquidity support to countries when needed.

As such, SDRs play a critical role in strengthening external buffers and supporting balance of payments needs, particularly during periods of external stress.

Further details from the report showed that the Central Bank’s short-term foreign assets were valued at US$9.3 billion, while long-term assets stood at US$219 million during the review period. Meanwhile, the Bank’s foreign liabilities amounted to US$5.21 billion.

The increase in SDR holdings, alongside developments in Ghana’s overall reserve position, underscores ongoing efforts to bolster external buffers amid continued macroeconomic adjustments and gains.

Norvan Reports